In the Philippines, GCash has become a bridge between merchants and customers. For merchants, an efficient and convenient payment method not only improves the customer experience but also significantly enhances collection efficiency. This article introduces the main features, technical advantages, and application scenarios of the GCash native payment API, showcasing the convenience and efficiency it offers to merchants.

1. Main Features of the GCash Native payment API

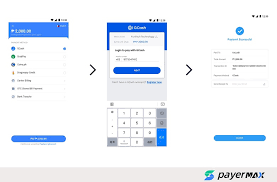

Quick Payment Integration: The GCash native payment API can be embedded directly into a merchant’s system, allowing users to complete payments without redirection to other pages. This seamless payment experience helps reduce user drop-off and improves payment success rates.

Instant Settlements: Through the GCash native API, merchants can achieve D0 real-time settlements, meaning funds are available immediately after a payment is made. This feature helps merchants manage cash flow more efficiently.

Multiple Payment Methods: The API supports QR code payments, phone number-based payments, and more, meeting diverse user preferences and enhancing payment convenience.

2. Technical Advantages of the GCash Native Payment API

High Security: The GCash native API employs multiple encryption layers and stringent identity verification processes, ensuring data security and transaction reliability.

High Concurrent Processing Capacity: The API is built to handle a high volume of concurrent payment requests, making it suitable for merchants with large daily transaction volumes. This ensures stability and speed during payment processing.

Compatibility and Flexibility: The GCash native API seamlessly integrates with existing payment systems and is compatible with both mobile and desktop platforms. It can also be customized based on specific merchant requirements, offering exceptional flexibility.

3. Application Scenarios for the GCash Native Payment API

E-commerce Platforms: The GCash native API is ideal for e-commerce platforms, allowing users to complete payments without leaving the platform. This enhances the shopping experience and speeds up the transaction process.

Gaming and Entertainment Apps: In gaming and entertainment, users can top up their accounts and make payments directly through GCash, improving user retention and boosting platform revenue.

Food and Retail Industry: For the food and retail sectors, the GCash native API enables customers to complete payments by scanning a QR code, eliminating the hassle of cash handling and simplifying checkout.

Cross-Border E-commerce: Cross-border merchants can use GCash to reach Filipino customers more easily, offering a local payment option that increases trust and comfort in the payment process.

4. Convenience and Efficiency Brought by the GCash Native Payment API

Enhanced User Experience: By removing redirections, GCash’s native payment method streamlines the user journey, reducing payment time and minimizing customer drop-off due to a complicated payment process.

Faster Cash Flow: Instant settlement allows merchants to track funds in real-time, speeding up cash flow and enhancing business liquidity.

Reduced Payment Failures: With high concurrency and system stability, the GCash native API effectively reduces payment failure rates, providing a reliable payment experience for both users and merchants.

Conclusion

With its technical advantages, convenience, and efficiency, the GCash native payment API has become an invaluable tool for merchants to enhance their collection efficiency. Whether for e-commerce, gaming, dining, or cross-border payments, the API offers significant convenience to both merchants and customers. By leveraging the GCash native API, merchants can improve customer satisfaction, optimize cash management, and gain powerful support for business growth.

bifu pay

bifu pay

发表评论

发表评论: