Many of my clients are keen on exploring innovative and intelligent payment solutions aimed at providing consumers with more flexible and convenient payment options.

“Buy Now, Pay Later” (BNPL) has rapidly become a trend over the past year, effectively easing consumers’ financial burden by breaking down large purchases into manageable small installment payments. For some, the concept of BNPL might sound familiar: Installment Payment Plans (IPP) have been around for a while, but fundamentally share a similar philosophy with BNPL.

Despite their similarities in form, there are several key differences between BNPL and IPP. This article will delve into the similarities and differences between IPP and BNPL to reveal which model better suits your business needs.

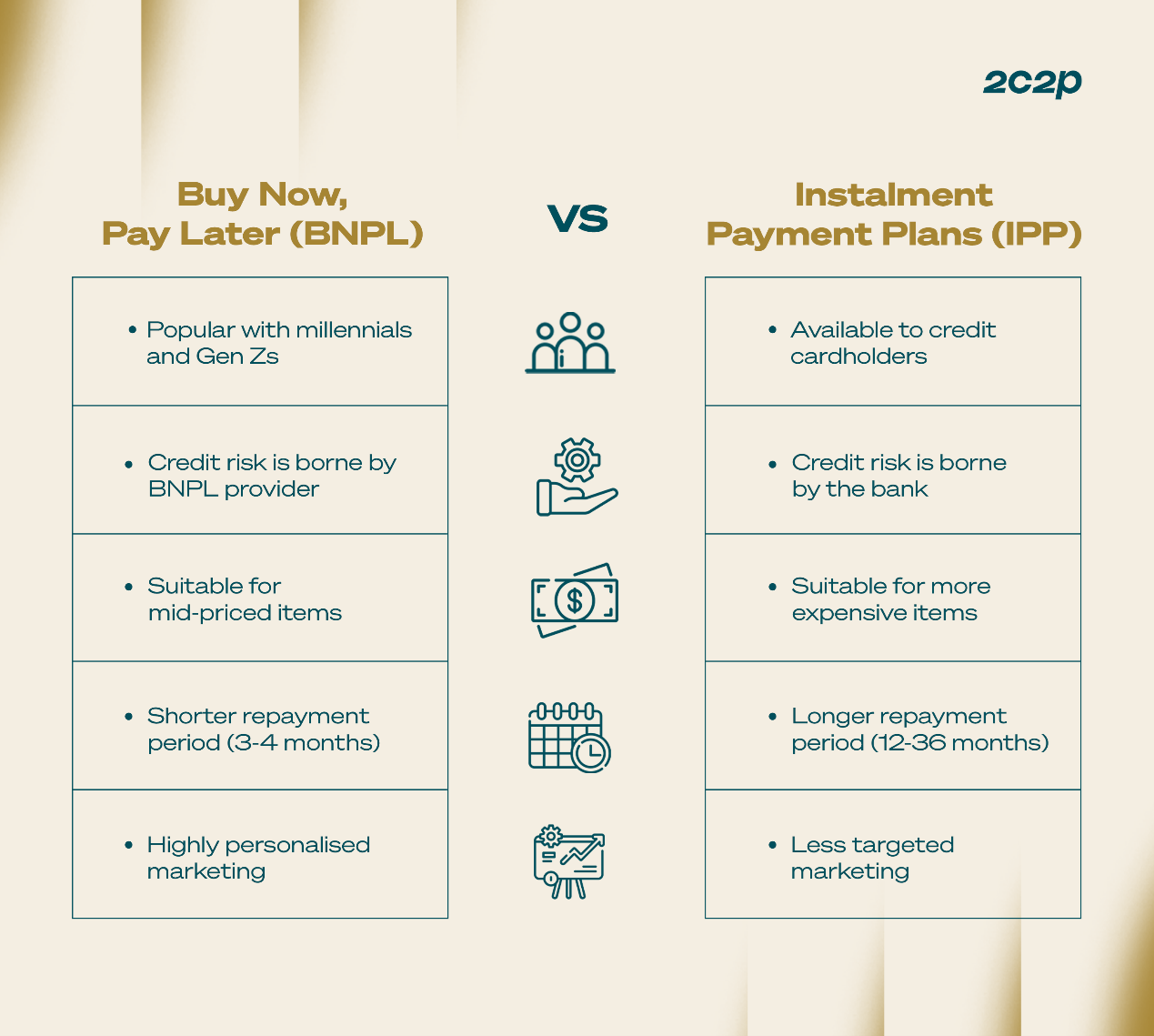

Buy Now, Pay Later (BNPL):

- ist-paddingleft-2">

Popular among Millennials and Generation Z

Credit risk is assumed by BNPL providers

Suitable for mid-range priced goods

Short repayment period (3-4 months)

Highly personalized marketing strategies

Installment Payment Plan (IPP):

Offered to credit card holders

Credit risk is borne by banks

Suitable for higher-priced goods

Longer repayment period (12-36 months)

Targeted marketing is relatively weaker

What is an Installment Payment Plan (IPP)? Given IPP’s earlier emergence, let’s start with its core characteristics. IPP is essentially a service linked to bank credit cards that converts one-time large purchases into monthly small installment repayments for up to 36 months. Its feature is directly embedded in the credit card system, utilizing the preset credit limit within the card.

Indeed, IPP provides an extremely convenient financial buffer for large expenditures, but it’s worth noting that the condition for enjoying interest-free installments is strict adherence to timely repayments.

Failure to repay on time can affect your credit score. In some countries or regions, banks may even charge a small interest for customers using IPP services.

What is Buy Now, Pay Later (BNPL)? Having understood IPP and how it operates, let’s talk about BNPL. BNPL is essentially a short-term financing scheme that allows consumers to pay for goods in installments over 3 to 4 months.

In recent years, BNPL has become a hot topic, especially in Southeast Asia where people favor this payment solution.

In fact, according to a report commissioned by BitPay PAY subsidiary 2C2P from IDC, BNPL spending in Southeast Asia is expected to grow by $7.9 billion from 2020 to 2025, achieving at least an astonishing 8.8-fold increase!

Here are the projected growth rates of BNPL in Southeast Asian markets from 2019 to 2025:

Indonesia: 1% → 6% Malaysia: 1% → 5% Philippines: 0% → 4% Singapore: 2% → 6% Thailand: 1% → 4% Vietnam: 0% → 3%

For an in-depth understanding of insights within the BNPL field, please listen to our podcast interview with hoolah founder and CEO Arvin Singh.

BNPL and IPP: Similarities BNPL and IPP reflect similarities in two key aspects:

Installment Mechanism: Both BNPL and IPP are based on installment payments that break down the total shopping amount into small installment amounts, allowing consumers to gradually repay over time.

Interest-Free: Under normal circumstances, both BNPL and IPP offer interest-free installments but will charge additional fees if there is overdue payment. The overdue interest for BNPL could be as high as over 25%; whereas IPP’s overdue fees are usually calculated based on a fixed ratio.

BNPL and IPP: Differences Despite their similarities, in reality, BNPL and IPP differ in many ways. Next, we will explore their key differences.

Credit Card Requirement: Firstly, one major difference between BNPL and IPP lies in whether a credit card is required. As previously mentioned, IPP requires linking with a bank credit card; customers’ installment limits are determined by the credit card issuing bank based on their credit status.

Conversely, BNPL does not require any credit card binding; therefore it is not limited by banking and credit card-specific lending regulations.

Target Audience & Customized Marketing: BNPL’s convenience of not requiring a credit card makes it particularly popular among Millennials and Generation Z.

While these two payment methods make shopping more enjoyable, consumers should still remain sensible when making choices and follow the principle of “planning ahead and spending within one’s means.”

About 2C2P

2C2P, a subsidiary of Antom, is a platform that provides comprehensive payment solutions, assisting businesses with secure payment transaction processing across online, mobile, and offline channels, and offers card issuing, bulk payments, remittances, and digital goods services.

With over 250 payment options ranging from credit cards to mobile wallets, and a vast alternative payment network consisting of more than 400,000 physical touchpoints, 2C2P has become the preferred payment service platform for tech giants, airlines, online marketplaces, retailers, and other global enterprises.

Looking to reach new heights in your business with digital payments? Our passionate team is always ready to help.

Contact our team now to embark on a secure payment journey.

bifu pay

bifu pay

发表评论

发表评论: